Moving up the value chain.

Case Study:

MetLife

Launch: 2021

Since cannibalized by core business

MetLife's brand had decayed into a “back of house” player causing consumers to forget who it was. Our research showed that it didn't matter if customers switched employers or benefits packages from MetLife to a competitor. Group benefits had been commoditized and MetLife's reputation with consumers along with it.

MetLife asked us to bring it back into the spotlight. It wanted to create a new business that provided direct value to customers rather than the detached value they had been providing behind several links in the value chain. To create that business they gave us a constraint and an outcome “Make the solution about financial wellness, and make it so that we keep those customers for life.”

Contributions

- Research

- Business Model Design

- Organizational Design

- Policy Design

- Concept Design

- Systems Design

- Product Design & Strategy

Chris' ability to combine creative vision & an understanding of user & business needs is impressive. While creating our product he threaded the needle on all of them.Oana Serban — Product Manager, MetLife

Finding Value

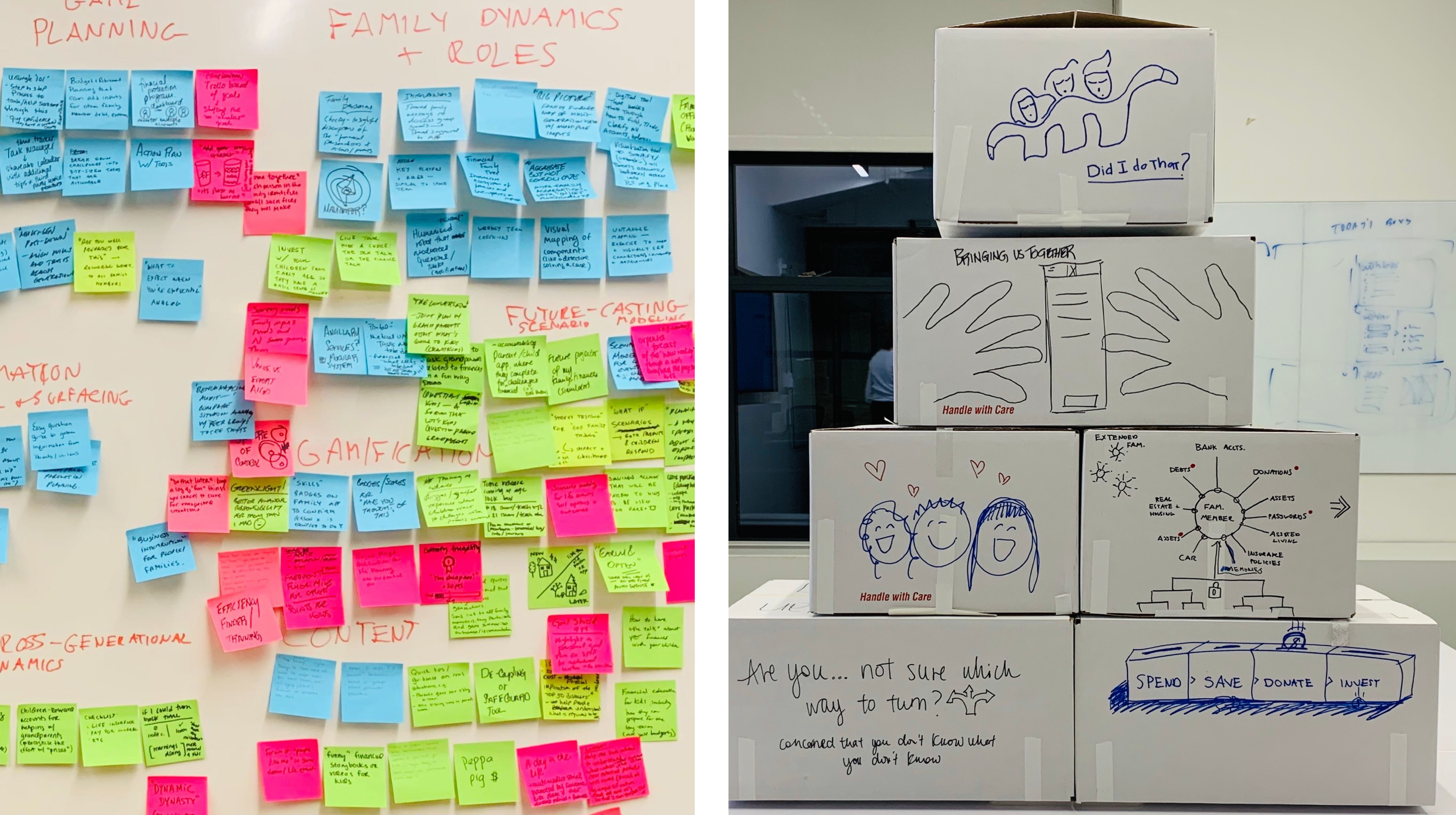

To understand what MetLife’s new business should be we started by talking to customers. We spoke to 3 demographic cohorts - millennials, young families, and the ready to retire. Each of these cohorts resolved to a core “job to be done” for their respective groups. These jobs served as the battle cry for concept development and ideation.

Raw Value

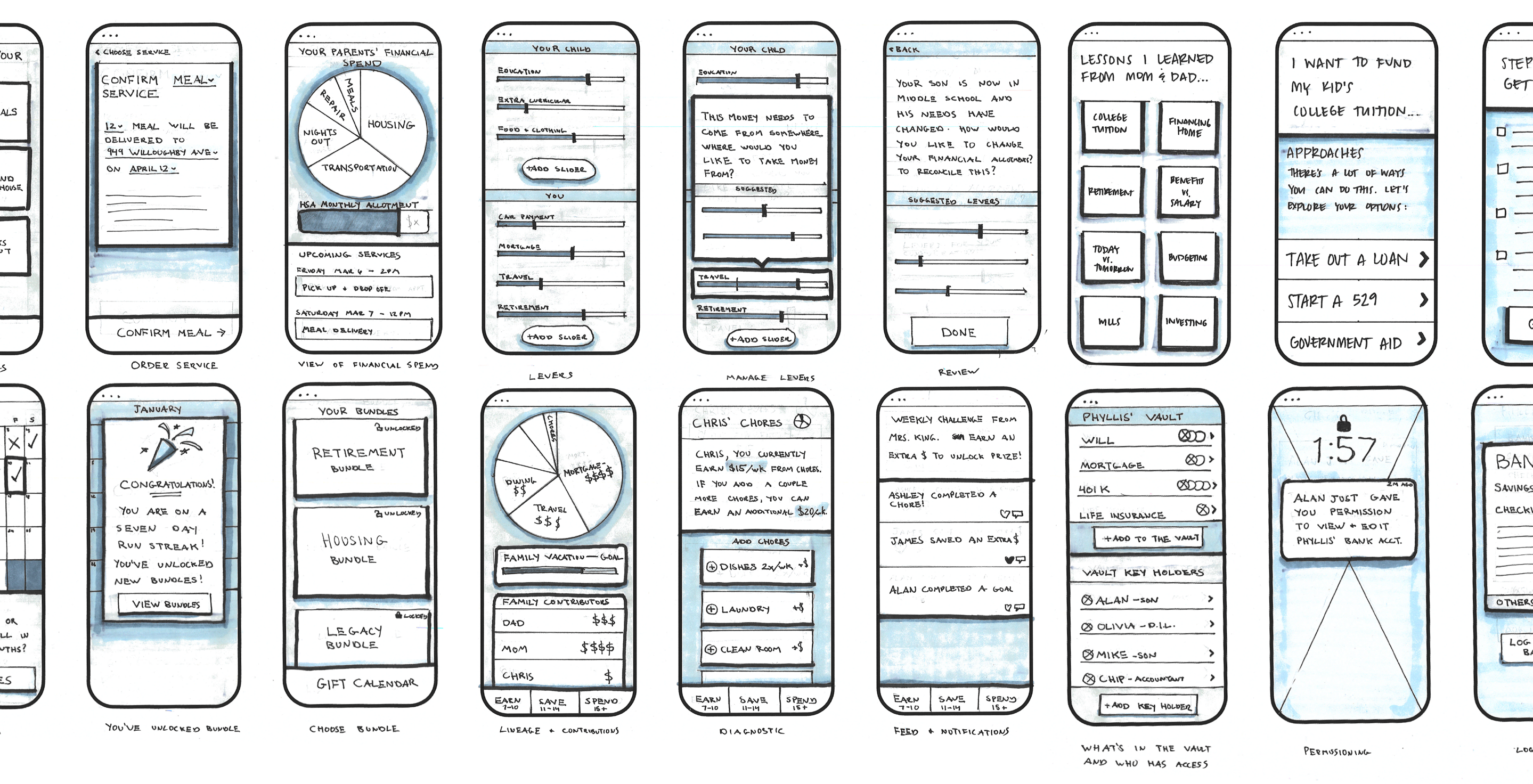

After synthesizing our research we worked on potential product ideas. One method we enjoyed was the design the box method because it forced us to think about value and benefits. When it was time to prototype those ideas we started with the lowest fidelity prototypes we could, paper prototypes. Paper allowed us to understand the essence of an idea without distracting ourselves or our users with implementation and experience details, allowing us to iterate on and uncover product value quickly.

Throughout our concept testing one key theme emerged… No one helps users take action. Financial advice is a dime a dozen, but truly helping someone take financial action is rare.

40+ Concepts Tested

72 Users Interviewed

Exchanging Value

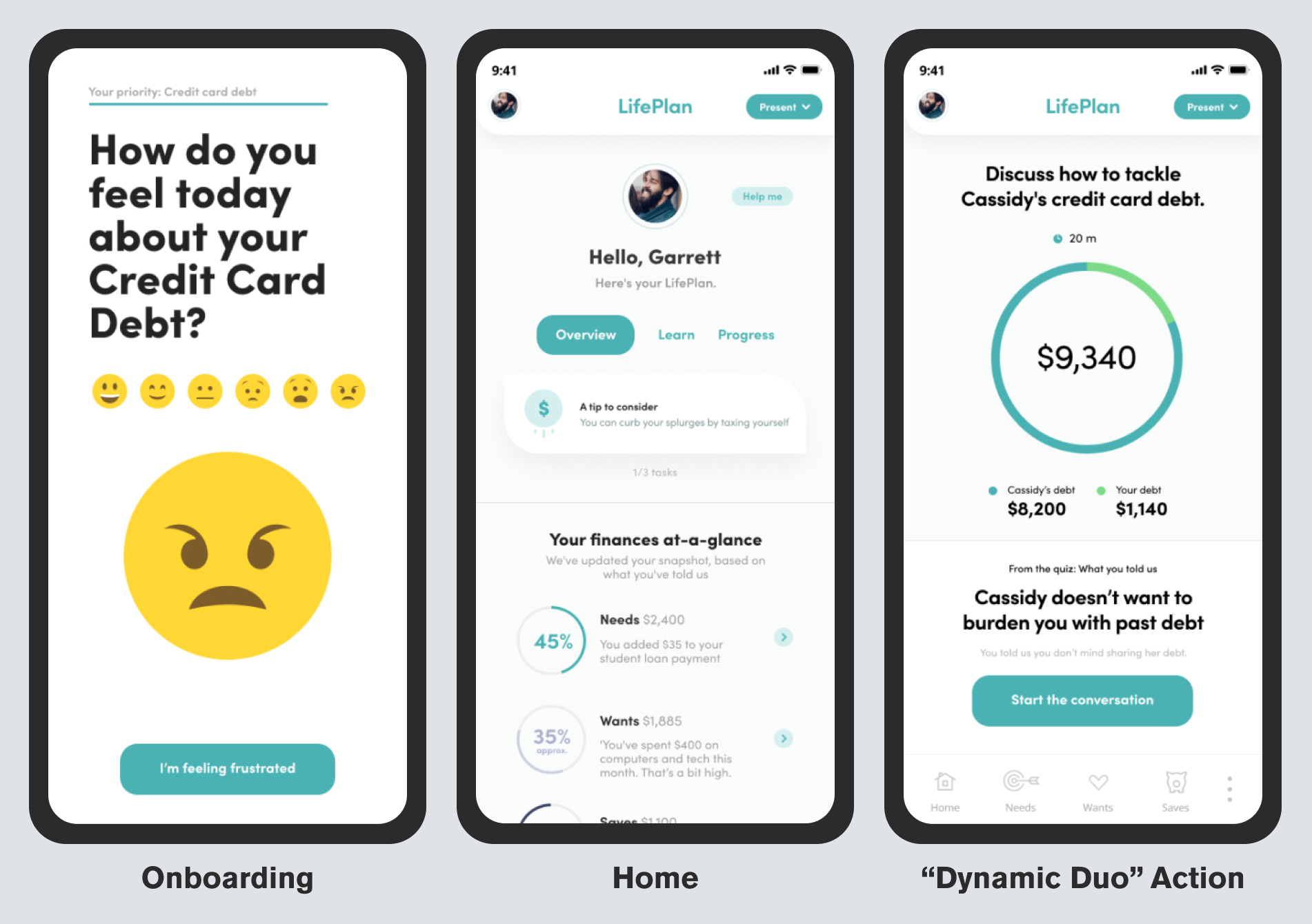

After testing numerous concepts with paper, we promoted those that showed the most promise. We increased the resolution of our concepts by digitizing them. This allowed us to understand if our concepts still worked when value exchange was required. Rather than reacting to concepts, now users must interact with them.

Team Motivation & Dopamine

It was important to me to keep the team energized. As we were creating the product and business from scratch we were wrong more times than we were right. It became important to stop, celebrate the wins, and feed off of them to keep creativity and motivation high. We captured user excitement as a way to inject the team with dopamine and illustrate that their hard work was paying off and getting us closer to the finish line.

Chris is an inspiring leader who fostered an environment where everyone’s ideas were valued & encouraged. It was a privilege to work with him & see the impact of his leadership.Kris Suntorn — Product Manager, MetLife

Using Moats

After rigorous concept testing the product model became clear… Give users a budgeting tool with actions (not recommendations) that can free up cash. Actions like canceling a subscription, adding a splurge tax to things you shouldn't buy, or facilitating financial conversations all proved valuable in testing. So we wanted to aggregate them together and use the intelligence of a budget to understand which action was best when. Actionable solutions exist in the market today. Think Acorns for round-ups which was novel when it first arrived, but it's been copied, commoditized, and placed everywhere. Our idea needed to be defendable. How might we use MetLife's sources of advantages to make our new product something that can't be duplicated by a leaner, faster startup?

Leaning on the existing brand

MetLife is not perceived as a financial services company in the same way banks are. This perception has both pros and cons. On the downside, MetLife's financial wellness solution feels off-brand. On the upside, users tend to trust MetLife more than traditional banks, as they don’t feel like MetLife is “out to get their money.” We leveraged this sentiment in two key ways.

First, we created a new brand. Upwise, that is signed “From MetLife”  . The signature communicates to our users that Upwise focuses on financial wellness rather than insurance, while still being supported by a brand they trust and likely rely on for insurance.

. The signature communicates to our users that Upwise focuses on financial wellness rather than insurance, while still being supported by a brand they trust and likely rely on for insurance.

Second, because MetLife is seen as trusted and caring about more than just finances, we have permission to ask users different questions than typical financial institutions. We ask questions that normal financial institutions won't. For example, we ask, “How do you feel about your debt?” in addition to “How much debt do you have?” This tactic further enhances MetLife's reputation and demonstrates our care for users as whole individuals. More importantly, capturing this data enables us to develop advantaged recommendation models, as we gather inputs that others do not.

01 Brand Created

Utilizing Scale

Building a Platform

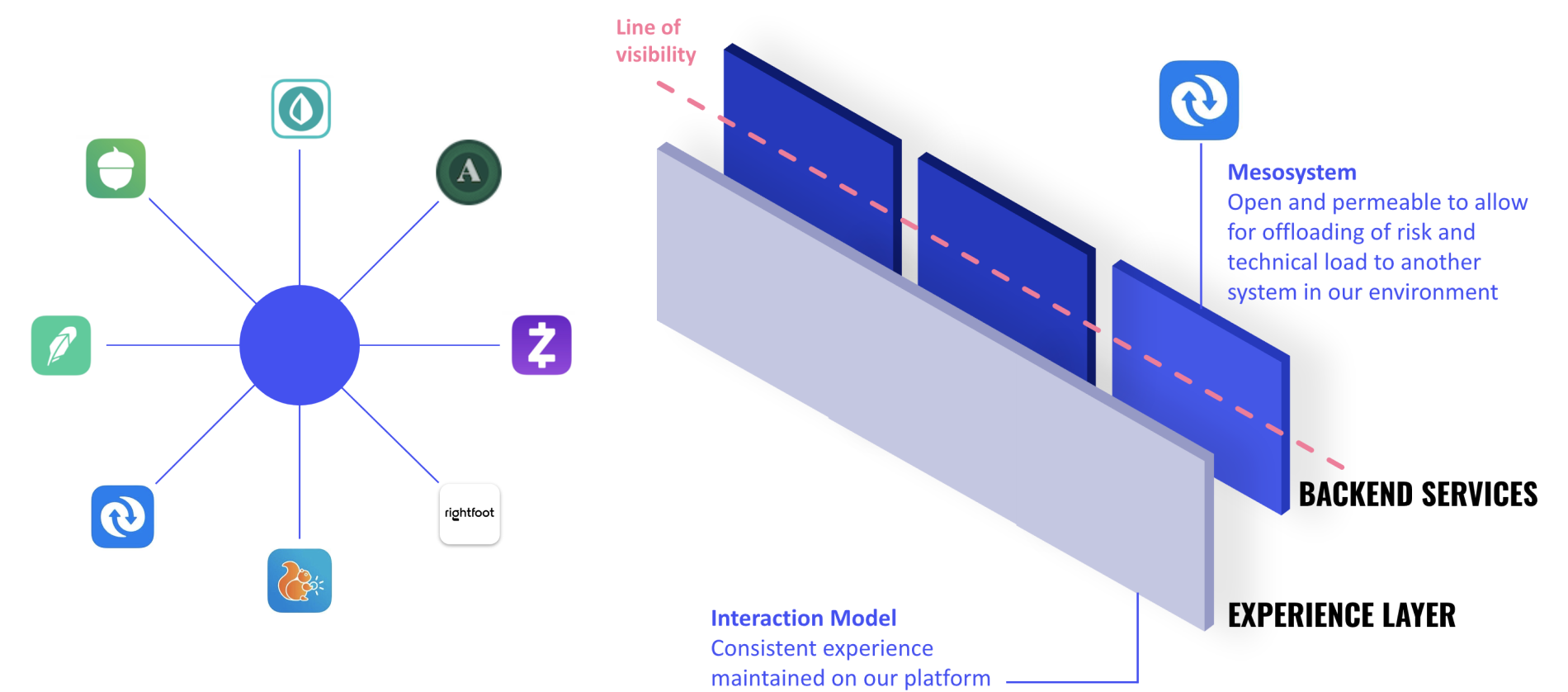

MetLife is an S&P 100 component and we used that scale to turn the product into a platform. MetLife provides benefits for nearly all of the Fortune 100 (96 to be exact). Meaning large players already do business with MetLife and smaller startups want to be in business with MetLife for its reach.

We leveraged this advantage by developing a set of open APIs and a developer experience akin to an App Store. This approach allows us to defend against technical debt and MetLife's challenges with product execution. Similar to an app store, fintechs can submit their financial actions to Upwise for approval. Once approved, Upwise integrates these actions into the platform for the recommendation model to suggest them. Upwise then shares the revenue that action generates and gives the fintech brand attribution. Our first financial action partnership was with Billshark a company that cancels subscriptions on your behalf.

The process was new to me. I remember at the beginning of each sprint saying “I think this idea is silly” but by the end of every sprint I caught myself saying ‘I like this, it could work’. Chris & his team always delivered.Paul Ricard — Partner, Oliver Wyman

Conway's Law

MetLife is an insurance company, and its structure reflects that. Building digital products is not part of its core. With Conway's Law in mind, we needed to design the organization so that it can build, ship, iterate, and maintain the product we wanted.

When designing the organizational model we adopted the “squad and tribe” model popularized by Spotify. This framework helped us organize our teams around experiences, and not features. During this process, we created a new set of job titles, aligned them with existing roles, and ensured they fit within the compensation bands of the legacy organization.

04 Squads Created

13 Team Members Hired

Policy Design

The collaboration between other parts of MetLife and Upwise also needed to be redesigned. Initially, when we began working on Upwise, the legal team's service level agreement was a two-week turnaround. While this process is appropriate for complex insurance policies, it was impractical for the agile startup Upwise aimed to be. To address this, we redesigned the interaction between Legal and Upwise. We embedded lawyers within Product and had them use Product’s tools, allowing legal to review copy in Figma, and our staging environment.

8x Reduction in Legal Turn Around

Chris has an incredible ability to use design methods & thinking across all types of challenges. He strung all of Upwise together. He designed the product experience, how it makes money, how we were organized, how we passed content off to legal, he even figured out a way to reduce tech debt.Alan Finch — Creative Director, Oliver Wyman